Amazon studies and statistics for sellers – all relevant developments of the last few years

Online shopping has become an integral part of the daily lives of many people over the past two years. This is evidenced by Amazon studies and statistics created after 2020, and is naturally reflected in the success of companies like Amazon, OTTO, eBay, Walmart, etc. However, Amazon clearly stands out as the winner in direct comparison with other e-commerce giants. In this blog post, we want to take a closer look at the development of Amazon, of course also from the perspective of Amazon sellers. Because such rapid growth – especially in such a short time – usually cannot have only positive aspects.

Customer orientation wins – The rise of Amazon

There are numerous Amazon studies and articles that deal with the rise of the company from a garage bookstore to the largest marketplace in the world, and all studies come to the same conclusion: Amazon is growing relentlessly.

The exponential growth of the online giant is particularly evident in the growth curve of the last 10 years. In 2010, the mail-order retailer generated revenue of 34.2 billion USD. Ten years later (2020), it was more than ten times that amount at 386.1 billion USD.

One of the causes for this is the management, which focuses on customer orientation and reinvesting profits back into the company to promote growth.

Among other things, these two elements have significantly increased revenue at Amazon over the last six years, as the statistics show. In particular, the year 2020 – fueled by the global pandemic-related e-commerce boom – was very lucrative for Amazon. Revenue increased by 33% compared to the previous year. Germany was one of the most successful markets for Amazon, with 29.6 billion USD.

In 2010, Amazon generated revenue of 34.2 billion USD. Ten years later (2020), it was more than ten times that amount at 386.1 billion USD.

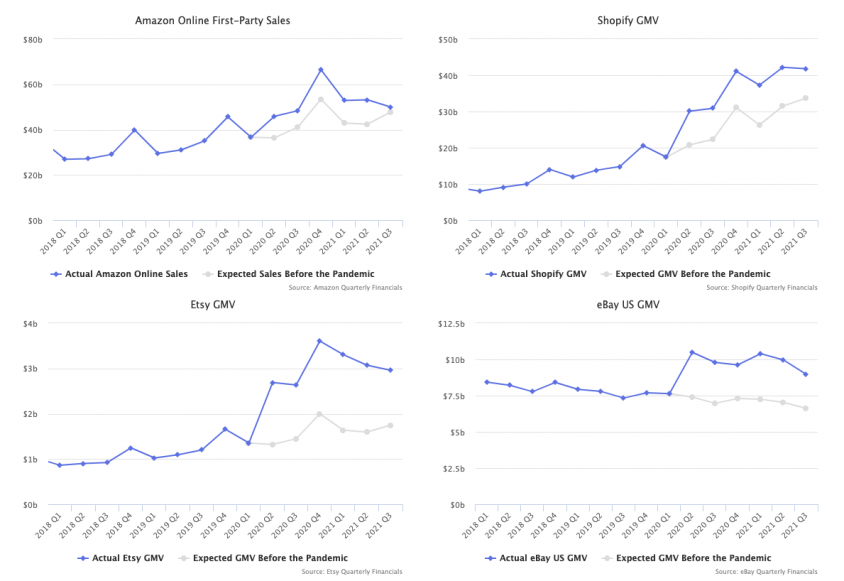

Such a trend cannot continue indefinitely, of course. According to Marketplace Pulse, a company that specializes in analyzing data from the e-commerce sector, the curve (at least in the U.S. market) has stabilized, and now only regular growth can be observed.

More customers = more competition

But what does this growth mean for marketplace sellers? Generally, it is a good sign when the platform on which you sell products generates more revenue than ever before. Sellers directly benefit from the increase in customers.

There are now 1.9 million active Amazon sellers. 240,000 sell on Amazon.de.

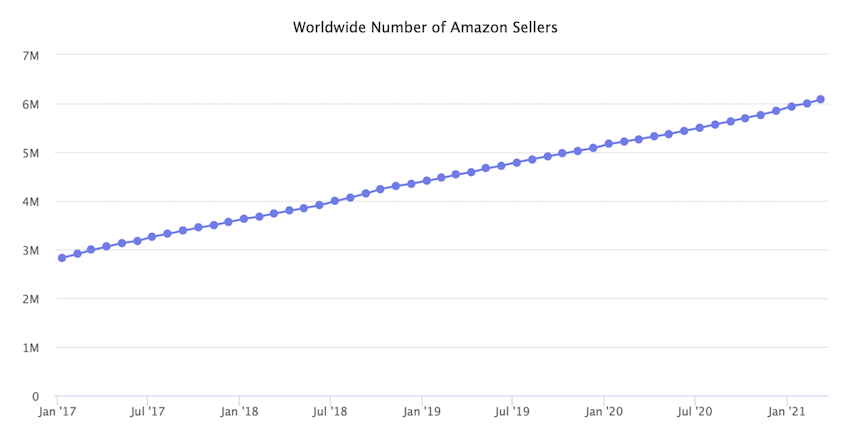

It also means that individual sellers must compete against much more competition. Worldwide, there are now about 9.7 million Amazon sellers, 1.9 million actively selling on the platform, and 240,000 based in Germany. And this is only the direct competition on Amazon. The e-commerce boom has naturally extended to other platforms as well. Although these are not as successful as the market leader, they offer customers other advantages.

For example, the platform Etsy attracts its customers with a specialization in handmade, creative products. A tactic that has proven successful and allowed the company to increase its revenue from 818 million dollars (2019) to 1.72 billion dollars (2020).

How do you stand out against such large competition?

Selling on Amazon has never been easy and has actually become even more difficult in the last two years due to high competition – according to Oberlo, 283,000 new sellers joined in the first quarter of 2021.

One way to stand out in such a competitive marketplace is to use intelligent software that allows for the automation of tedious (but necessary) processes. Fun fact: Amazon does it the same way at the end of the day, as this graphic shows us.

Price optimization

The final price is the most important metric to win the Buy Box and thus achieve very high visibility of one’s products on the product detail page. However, the final price of products on Amazon is constantly changing, making manual adjustments nearly impossible.

The Repricer of SELLERLOGIC not only ensures a high Buy Box share but also that you sell your products at the highest possible price. More information can be found here.

Refund claims from FBA errors

Although Amazon now employs more robots than human employees, people are still the decision-makers in the warehouses. And people make mistakes. That’s not a problem. It is just unacceptable that you, as a seller, have to pay for the mistakes that happen in the warehouse with your products.

The Lost & Found software from SELLERLOGIC identifies FBA errors up to 18 months in the past. These errors are then processed by our Customer Success Team, who will contact Amazon with you to enforce your refund claim. More information can be found here.

Disrupted supply chains

What had already been noticeable throughout the year became particularly evident at Christmas 2021: The international supply chains could not withstand the high demand, resulting in very high prices and extremely slow logistics. In addition to the aforementioned imbalance, other factors such as labor shortages, unfavorable navigation maneuvers in the Suez Canal, port closures, and typhoons played a significant role. This was especially noticeable on the routes from Asia to Europe and/or America, reflected in increased prices and slower logistics.

In the last 18 months, prices for sea freight from Asia to Europe increased by 700 percent. In the USA, they rose by 900 percent last year.

For the route from Asia to Europe, prices currently stand at 16,000 dollars per 40-foot container (as of January 2022). Eighteen months ago, the same container cost around 2,000 dollars. For the logistics industry and shipping companies, this is, of course, a dream come true – at least financially. However, as a business owner, one must first be able to afford these high prices.

The same situation in the USA; in 2021, prices for sea freight of goods from China increased fivefold. Compared to pre-pandemic prices, the rates are ten times higher. Freight rates for containers rose from 1,500 dollars (early 2020) to over 20,000 dollars (September 2021). By the end of 2021, prices dropped again and are now at 15,000 dollars.

Producing in Europe?

The question that sellers have been asking themselves for some time now, even before Corona, is becoming more relevant than ever due to these supply chain issues: Is it worth producing in Europe?

The manufacturing costs in Europe are much higher than in Asia; however, the shipping costs are significantly lower, and the quality is usually higher. Another advantage of “local” production is that a trip to another European country (e.g., to inspect the goods or meet the manufacturers in person) is cheaper and less time-consuming than a trip to Asia. Moreover, producing in Europe is also more sustainable from an ecological perspective due to the shortened delivery route – another factor that can be converted into more sales with the right marketing.

And what are the vendors doing?

This question is answered by a current Amazon study by Pattern and Profitero, EMEA Amazon Vendor Survey, in which 56 brands are surveyed about the challenges and opportunities in Europe and the Middle East.

It is noteworthy that many brands sell through multiple channels, e.g. through other e-commerce platforms (48.2 percent). Of these platforms, eBay is the most popular (39.3 percent), but Cdiscount is also performing well (25.2 percent)

Also interesting is the level of satisfaction of vendors with the online giant. Less than half (45 percent) of all surveyed parties stated that their relationship with Amazon is “somewhat positive.” 25 percent indicated a neutral relationship and 25 percent described their relationship as “somewhat negative.”

The reasons for this modest result are issues with price erosion (59 percent), an overly expensive and complicated logistics on the part of Amazon (85.2 percent), insufficient space in warehouses (66.1 percent), and disruptions in the supply chain (50 percent).

Presumably, some vendors will consider adopting a hybrid strategy in the coming years and selling both as a seller and as a vendor.

Amazon studies and statistics – Conclusion

Amazon, as an e-commerce giant, has gained many customers in recent years. You as a seller benefit directly from the ever-growing customer base. However, the rapid growth also means that you have to compete against much more competition. Many Amazon sellers rely on software in such cases.

The bottlenecks in the supply chains (especially from Asia to the West) have also been noticeable since the beginning of the pandemic, but peaked at the end of 2021, which – at least in Europe – has not yet subsided. A sustainable alternative that is becoming increasingly attractive for German e-commerce sellers: having products manufactured locally.

Amazon vendors are currently also struggling with similar problems, notably the complicated and expensive logistics of Amazon, lack of warehouse space, supply chain bottlenecks, and price erosion.

Image credits in the order of the images: Fig. 1, 2, 3 & 6 @ marketplacepulse.com / Fig. 4 @ cbinsights.com / Fig. 5 @ fbx.freightos.com / Fig. 7 @ pattern.com; profitero.com